Week in Review…

Amid the plethora of economic reports and a Federal Open Market Committee (FOMC) meeting, market indices closed the week slightly higher as markets grappled with a resilient economy and future inflation expectations.

- The S&P 500 rose by 0.51%

- The Dow Jones Industrial Average increased by 0.60%

- The tech-heavy Nasdaq rose by 0.17%

- The 10-Year Treasury yield closed at 4.25%

The FOMC decision to maintain the federal funds rate at 4.25% to 4.5% was the week’s key development, signaling a cautious approach amid economic uncertainties. The Fed acknowledged solid growth and a strong labor market but remains vigilant about persistent inflation. Their data-dependent strategy, coupled with a slowed pace of Treasury security reduction, reflects a delicate balance between maximizing employment and returning inflation to the 2% target.

Retail consumer data provided a mixed picture. Core retail sales met expectations with a 0.3% month-over-month increase, a welcome recovery from January’s revised -0.6%. Headline retail sales, while positive at 0.2% and a substantial improvement from the previous month, fell short of forecasts. Business inventories aligned with projections, growing by 0.3%. The NY Empire State Manufacturing Index, known for its volatility, offered a surprisingly bearish outlook at -20.0, which should be interpreted with caution.

February’s housing data revealed a potentially more resilient sector. Housing starts surged to 1.501 million, well above forecasts, indicating a strong rebound from January’s dip. Existing home sales also surpassed expectations, reaching 4.26 million. While building permits saw a slight decrease to 1.456 million, the overall trend suggests January’s housing slowdown may have been an anomaly, and the market could be exhibiting stronger underlying momentum.

Spotlight

Gold in Modern Portfolios: Balancing Diversification, Inflation Hedging, and Safe Haven Potential

I. Introduction: Gold’s Enduring Appeal

Gold has long been valued in finance as both a currency and a store of value. Its qualities – durability, scarcity, divisibility, and fungibility – have cemented its historical status. In modern portfolios, gold is considered for diversification and hedging, but its role as a “safe haven” requires nuance. This article explores gold’s significance, diversification benefits, its role as an inflation hedge, its long-term performance, and portfolio allocation, acknowledging investor profiles, market conditions, and the limitations of gold as a safe haven.

II. Diversification Benefits and Modern Portfolio Theory

Gold’s inclusion in a diversified portfolio aligns with Modern Portfolio Theory (MPT), which suggests that an optimal portfolio maximizes expected returns for a given risk level. Gold’s unique characteristics,

including its low or negative correlation with equities and bonds, can enhance risk-adjusted returns and potentially reduce portfolio volatility. Studies indicate that adding gold can, in some cases, improve returns and Sharpe ratios while lowering drawdowns.

However, correlations across asset classes are not stable. Gold’s behavior varies; there are periods when it moves with the stock market and others when it moves oppositely. At times, gold acts as a hedge against a falling stock market, highlighting its role in a diversified portfolio. Gold’s volatility is often driven by sharp upside movements rather than corrections, making it a valuable asset during market distress. Combining gold with equities can, at times, result in a portfolio with lower volatility than standalone assets.

III. Gold as an Inflation Hedge

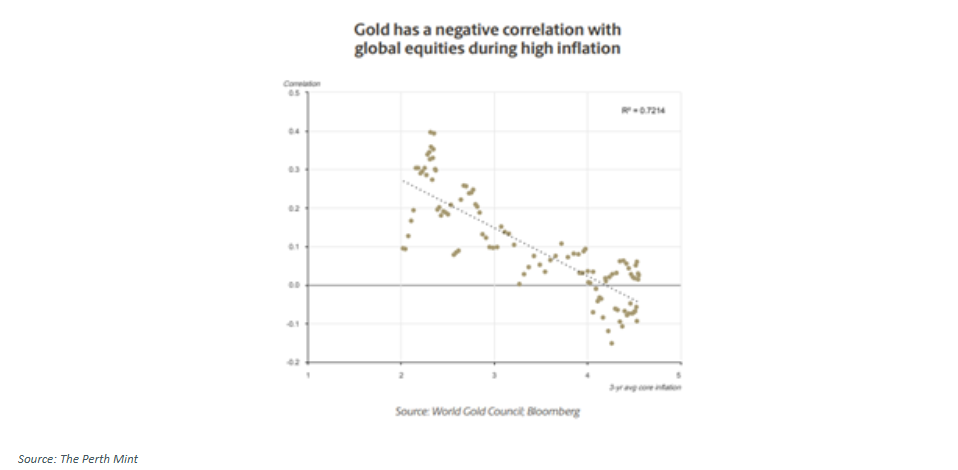

Gold often performs well during inflationary periods, preserving wealth and purchasing power by hedging against price inflation and currency devaluation. Its negative correlation with global equities during high inflation highlights its diversification value. As inflation rises, the typical negative correlation between stocks and bonds may weaken, making gold a valuable component for portfolio stability. This inflation hedge potential is crucial to its long-term value.

(click image to expand)

IV. A Nuanced View of Its Safe-Haven Status

Gold has shown strong long-term performance, and its ability to preserve wealth and purchasing power makes it a consideration for long-term investment strategies. However, the perception of gold as a “safe haven” requires a nuanced perspective.

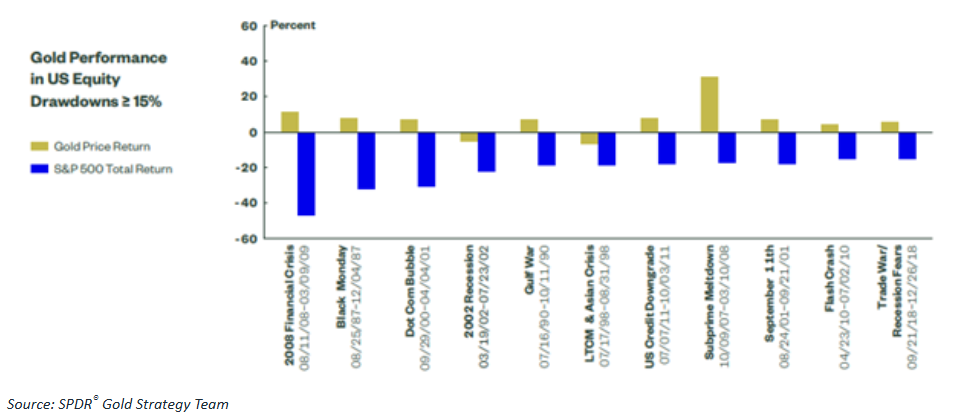

Research by Baur and McDermott (2009) highlights that gold can serve as both a hedge and a safe haven for major European stock markets and the U.S., but not necessarily for other developed or emerging markets. The study distinguishes between weak and strong forms of a safe haven, suggesting gold may act as a stabilizing force by reducing losses during extreme negative market shocks, but this effect is more pronounced in developed markets. The chart below reveals gold’s performance in U.S. equity drawdowns of 15% or greater.

(click image to expand)

Further analysis by Kuck (2019) reveals that while gold doesn’t move in tandem with stocks, it can exhibit significantly higher volatility in response to negative shocks in the equity market, and this increased volatility can contribute to the risk of a portfolio composed of both gold and equities. The study emphasizes that the effectiveness of gold as a safe haven depends not only on its return behavior but also on its volatility dynamics.

Moreover, the safe haven property of gold is not stable over time. The relationship between gold and equity markets can vary depending on market conditions. During certain periods, gold may act as a hedge, while in others, it may co-move with equities, reducing its effectiveness as a safe haven. This variability underscores the importance of understanding the dynamic nature of correlations between gold and other assets.

While gold can provide some protection during market downturns, it is not an infallible safe haven. Investors should be aware of the potential for increased volatility and the changing nature of gold’s relationship with equity markets.

V. Portfolio Allocation: Tailoring Gold to Individual Needs

Determining the optimal percentage of gold allocation in a portfolio depends on various factors, including risk tolerance, investment objectives, and time horizon. Recommendations from different financial institutions suggest allocations ranging from 5% to 15%, as a modest allocation of 5% to 10% can provide diversification benefits without overly exposing the portfolio to gold’s inherent volatility. Gold’s allocation should be tailored to individual investment goals and market conditions. Investors should periodically review their portfolio to ensure that the gold allocation remains aligned with their overall strategy and risk tolerance.

VI. Conclusion: Gold’s Role in a Balanced Portfolio

Gold remains a unique asset class with a distinct role in investment portfolios. Its dual nature as both a commodity and currency, coupled with its potential to hedge against inflation and diversify portfolios, makes it a consideration for investors. However, it’s crucial to acknowledge that while it can offer some resilience, particularly in certain market conditions, it is not a guaranteed safe haven. A balanced approach to incorporating gold into a portfolio, considering both its potential benefits and limitations, is essential for effective risk management.

Works Referenced:

Arnott, Amy C. “How to Use Gold in Your Portfolio.” Morningstar, Inc., February 27, 2024. Accessed March 20, 2025. https://www.morningstar.com/portfolios/how-use-gold-your-portfolio.

Baur, Dirk G., and Thomas K. McDermott. “Is Gold a Safe Haven? International Evidence.” Journal of Banking & Finance 34, no. 8 (2009). http://ssrn.com/abstract=1516838.

Kuck, Konstantin. “Gold and the S&P500: An Analysis of the Return and Volatility Relationship,” August 19, 2019.

Merk, Axel. “The Case for Gold: Optimal Portfolio Allocation.” Report. Merk Investments LLC, 2014.

SPDR® Gold Strategy Team. “The Role of Gold in Today’s Global Multi-Asset Portfolio,” n.d. https://www.ssga.com/library-content/pdfs/etf/us/b30-spdr-the-role-of-gold-in-todays-global-multi-asset-portfolio.pdf.

The Perth Mint. “Gold’s Role in a Modern Portfolio – Why Now Is the Time to Invest in Gold.” The Perth Mint, 2023.

Tiempo Capital. “The Future of Gold: Understanding Gold as a Strategic Asset in Portfolios,” 2024.

Week Ahead…

Following the Federal Reserve’s decision to maintain interest rates this week, the market is poised for a week of critical economic indicators and data releases. The Fed’s outlook, which suggests a potential 50-basis-point cut by year’s end, has set the stage for heightened attention to inflation metrics – particularly the impact of tariffs on prices. The Fed Chair described the influence of tariffs as transitory, indicating that any significant effects may not be immediately evident.

The upcoming Personal Consumption Expenditures (PCE) data, set to be released on Friday, is unlikely to reflect substantial changes stemming from tariffs in the short term. This will be closely monitored by analysts and investors alike, as it could influence perceptions of inflation trends moving forward. Additionally, the state of consumer confidence will be another focal point, especially after a steep decline last month. Observers will be eager to see if confidence improves amid ongoing economic uncertainty, as this could impact consumer spending and overall economic activity.

On Monday, the Manufacturing Purchasing Managers’ Index (PMI) and Services PMI will be announced, providing insight into the health of these critical sectors. These indices are essential for gauging economic expansion and overall activity, which could be influenced by both consumer sentiment and inflation expectations.

Finally, on Thursday, the final estimate of Q4 gross domestic product (GDP) will be released, with market participants alert for any significant revisions from previous estimates. Any notable changes could have implications for economic strategies and Fed policy considerations moving forward.

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.