Weekly Market Commentary | September 30th, 2024

Week in Review…

The financial markets demonstrated resilience this week, with most major indices posting positive results.

- The S&P 500 rose 0.62%

- The Dow Jones Industrial Average climbed 0.59%

- The Nasdaq Composite finished the week up 0.95%

- The 10-Year Treasury yield ended the week at 3.75%

This week’s positive momentum across various market segments suggests a generally optimistic investor sentiment, despite ongoing economic uncertainties.

Following the Federal Reserve’s decision to cut interest rates by 50 basis points last week and the economic data releases this week, the 10-year Treasury yield has risen by 18 basis points to 3.75%. The six-month yield, which reflects expectations of future Fed policy rates within the next six months, has fallen after the rate cut. Conversely, longer-term yields are influenced not only by rates but also by long-term inflation expectations, which have risen as the economy, albeit slowing, remained strong.

The Manufacturing and Services Purchasing Managers’ Indices (PMIs) were released on Wednesday. While the Manufacturing PMI remained in contraction territory at 47.2, the pace of contraction slowed compared to last month. The Services PMI in August remained in expansion territory at 51.5%.

On Thursday, initial jobless claims surprised the market by dropping to a four-month low, suggesting that the labor market remains fairly healthy.

The Personal Consumption Expenditures (PCE) index, the Fed’s preferred gauge of inflation, came in at 2.2% on Friday, lower than market expectations. This reading is down from 2.5% in July and represents the weakest figure since February 2021. Core PCE, which excludes volatile food and energy prices, rose 2.7% from a year ago.

Meanwhile, consumer sentiment from the University of Michigan extended its gains, ultimately rising more than 3% above August levels. The expectations index is now 13% higher than a year ago, reflecting greater optimism across a broad swath of the population.

Spotlight

A New Chapter in Monetary Policy?

The Federal Reserve’s primary objectives are to promote maximum employment, stable prices, and moderate long-term interest rates, often referred to as its “dual mandate” of maximum employment and price stability. The Fed uses rate cuts as a tool to stimulate economic growth and employment by lowering borrowing costs for businesses and consumers, which are meant to encourage spending and investment, though they must balance this against the risk of fueling inflation.

Looking in the rear-view mirror, the Federal Reserve’s interest rate policy has undergone significant shifts over the past four decades, reflecting changing economic conditions and challenges.

1980-2015: Combating Inflation, Stability, and Crisis Management

In the 1980s, the Fed focused on combating high inflation with rates reaching a peak of 20% in 1980. As inflation subsided, the Fed’s attention turned to managing economic growth and stability. The 2000s and 2010s saw the Fed navigating through multiple crises. Following the dot.com bust and 9/11 attacks, the Fed cut rates 13 times between 2001 and 2003, reaching as low as 1%. The 2008 global financial crisis prompted even more drastic action, with rates slashed to near-zero (0-0.25%) by December 2008. This ushered in an era of unprecedented low rates that lasted until 2015.

2015-2024: Normalization, Pandemic, and Inflation Response

The post-2015 period saw a gradual normalization of rates, with the Fed implementing small, consistent hikes. However, this trend was abruptly reversed in 2019 due to economic concerns, leading to three rate cuts. The COVID-19 pandemic in 2020 forced the Fed to make two emergency cuts, rapidly bringing rates back to the 0-0.25% range.

The post-pandemic era has been marked by high inflation, prompting the Fed to implement its most aggressive rate hikes in 40 years. By July 2024, the federal funds rate had reached 5.25-5.50%. However, recent economic indicators have led the Fed to initiate a rate cut cycle, with the first cut of 50 basis points in September 2024, bringing the rate to 4.75-5.00%.

Implications of Fed Rate Cuts

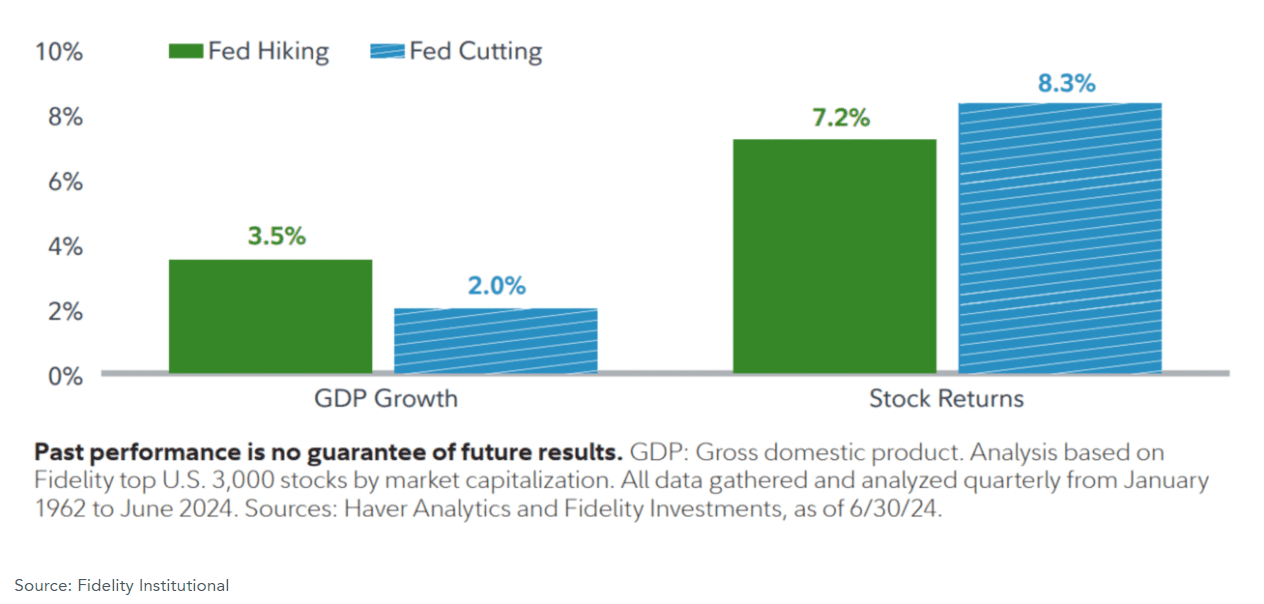

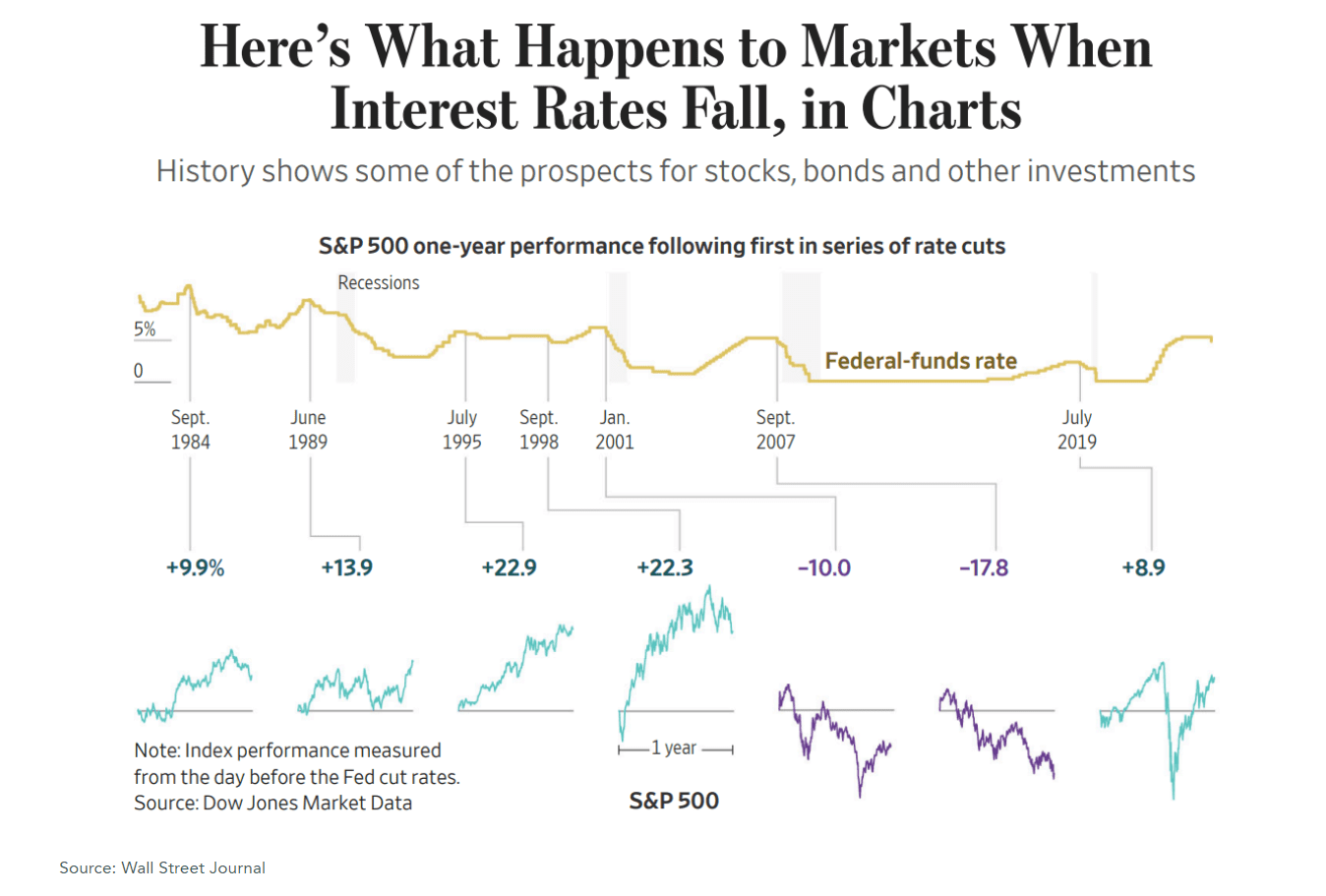

The impact of Fed rate cuts on the stock market is not as straightforward as one might expect. Historically, GDP has tended to grow faster during rate hike periods than during rate cut cycles. This suggests that economic conditions drive rate decisions, rather than the other way around.

Using the S&P 500 as a proxy for the stock market, performance following rate cuts has been only slightly better than during rate hike periods. Since 1962, the odds of a 12-month advance in the S&P 500 have been nearly identical whether the Fed was raising rates (71%) or cutting them (70%). This indicates that other factors beyond interest rates play significant roles in stock market performance.

However, fundamentally, rate cuts can have indirect positive effects on the stock market. Lower rates typically improve banks’ willingness to lend, which can support economic growth and corporate earnings. Historically, per Fidelity’s research, when the Fed cut rates while willingness to lend was in negative territory, lending conditions improved 89% of the time. The research also highlighted that improved lending conditions have been strongly correlated with corporate earnings growth. When willingness to lend is in positive territory and accelerating, corporate earnings have grown over the next 12 months in 98% of instances since 1966, with the exception of the pandemic, with an average growth of 15%.

It’s important to note that the current economic environment differs from historical norms. Unlike past rate-cutting cycles where bank lending was high and starting to falter, the recent cycle began with bank lending already in negative territory and showing signs of recovery. This unique situation could potentially lead to different outcomes compared to historical patterns.

What about the American consumer? Fed rate cuts primarily impact short-term interest rates, such as those for credit cards. While they can influence mortgage rates, the relationship is indirect. Mortgage rates, especially for refinancing, are more closely tied to the 10-year Treasury yield and overall market expectations than to Fed actions. However, Fed decisions can still affect long-term rates by shaping economic outlook and market expectations.

As the economic landscape continues to evolve, the Fed’s commitment to its dual mandate of price stability and maximum employment will likely shape future rate decisions, with careful consideration given to incoming data and potential risks.

Week Ahead…

The focus of the market this week will be on employment, with Federal Reserve Chair Jerome Powell’s press conference setting the tone early on. Given the Federal Reserve’s explicit commitment to supporting the labor market, this week’s employment data could serve as a key indicator for future rate cuts.

On Monday, Jerome Powell will address the public for the first time since the recent Federal Open Market Committee press conference. Market participants will closely analyze his language, seeking insights into the framework for future rate cuts. Powell faces the challenge of reaffirming the Fed’s commitment to employment while reassuring markets that inflation will remain under control. His ability to balance these objectives will be closely watched.

The week is packaged with crucial employment reports:

- Tuesday: Job Openings and Labor Turnover Survey (JOLTS) for August, providing insights into employment, job openings, recruitments, and new hires.

- Wednesday: ADP Nonfarm Employment Change, offering an early indicator of employment trends.

- Friday: Bureau of Labor Statistics Nonfarm Payrolls and the headline unemployment rate for September.

These reports will be scrutinized in light of the Federal Reserve’s recent 50 basis point interest rate cut, which underscores their renewed focus on full employment. Market participants will need to navigate this paradox, interpreting whether good news for the economy might be bad news for monetary policy, or if bad economic news could be good news for future rate cuts.

This content was developed by Cambridge from sources believed to be reliable. This content is provided for informational purposes only and should not be construed or acted upon as individualized investment advice. It should not be considered a recommendation or solicitation. Information is subject to change. Any forward-looking statements are based on assumptions, may not materialize, and are subject to revision without notice. The information in this material is not intended as tax or legal advice.

Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Socially responsible investing does not guarantee any amount of success. Clients and prospective clients should be prepared to bear investment loss including loss of original principal. Indices mentioned are unmanaged and cannot be invested into directly. Past performance is not a guarantee of future results.

The Dow Jones Industrial Average (DJIA) is a price-weighted index composed of 30 widely traded blue-chip U.S. common stocks. The S&P 500 is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The NASDAQ Composite Index is a market-value weighted index of all common stocks listed on the NASDAQ stock exchange.